Pilot Insights | Improving micro merchant incomes in Cameroon through stablecoin cross-border payments

Photo courtesy of Reasy

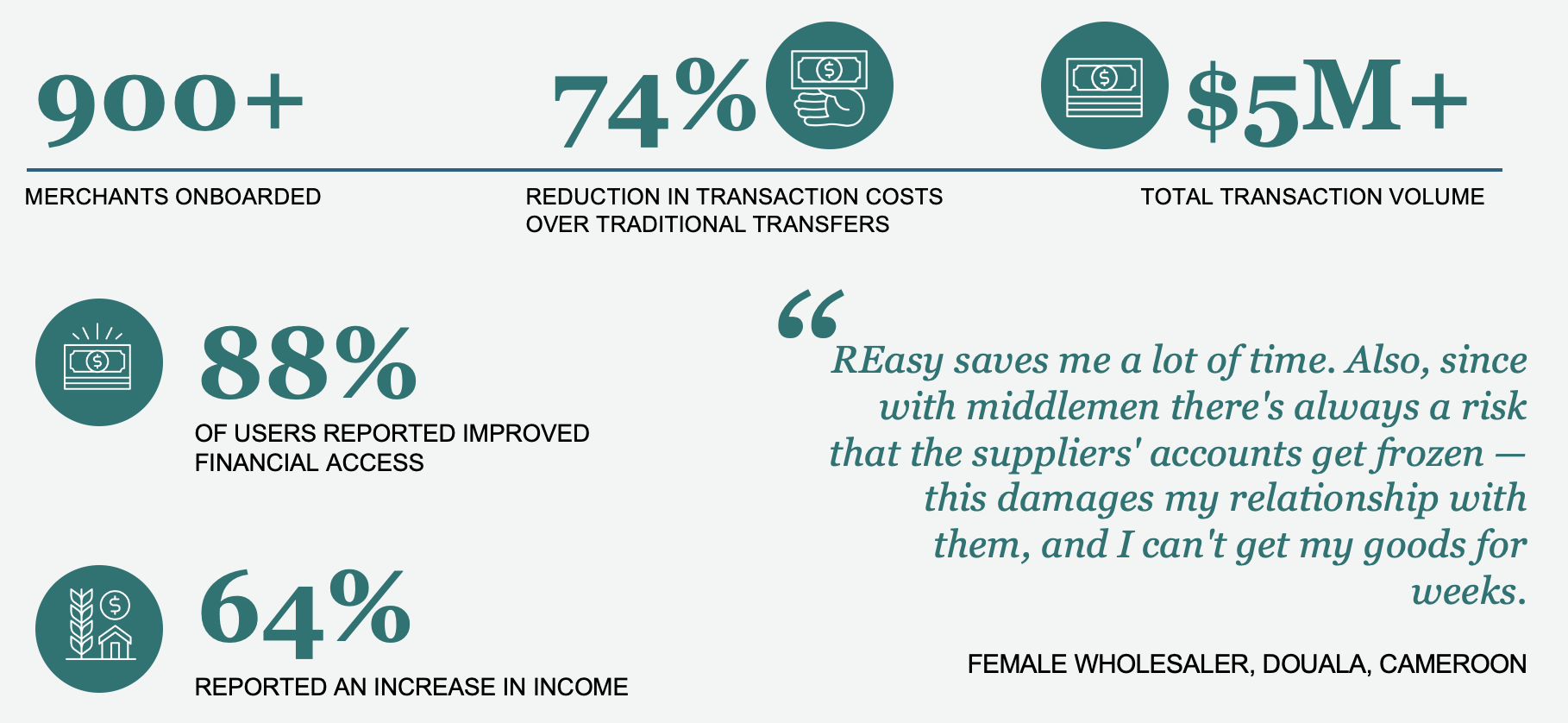

Mercy Corps Ventures partnered with REasy to pilot stablecoin transfers for micro-merchants paying suppliers in China, offering faster, safer, and cheaper transactions. $5.1M was transferred by 913 merchants, of which 27% were women. Merchants could top up their accounts locally through mobile money, bank transfers, or in cash, then send stablecoin payments that settled almost instantly. Suppliers in Asia received funds through their preferred channels, including Alipay and WeChat Pay, which have a combined user base of more than two billion in China.

Micro, small and medium enterprises (MSMEs) are vital to Africa's economy, contributing 40% of GDP and employing over 50% of the workforce. However, most MSMEs operate informally, without access to traditional banking, limiting their growth potential. While cross-border trade is rising, with Asia accounting for over 40% of Africa’s imports and exports, informal MSMEs face financial exclusion, often turning to costly black market channels where over 60% of cross-border transactions occur outside formal banking, with high intermediary fees (as high as 20%) eroding profits.

Insights in Brief

REasy reduced transaction costs for Cameroonian micro merchants by roughly 75%, lowering end to end fees to about 5-6% compared with the 15-20% typically charged through black market transfer channels. By leveraging stablecoins to replace opaque informal methods, the pilot removed a major friction in cross border payments.

The operational efficiency from using stablecoins strengthened the climate resilience and financial wellbeing of micro merchants, with 64% reporting higher incomes during the pilot and nearly a quarter (23%) seeing gains above 20%. Beyond income, 88% of users reported improved financial access and 65% felt more prepared for climate related shocks, citing improved security, greater autonomy, and reduced costs.

The platform increased merchants’ ability to purchase goods and place orders more frequently by reducing payment and delivery times. 58% of merchants saved 2-5 days on delivery, and 12% saved more than five days, allowing for faster stock turnover. By replacing informal transfer methods with blockchain rails that smooth cross border frictions, the pilot eased constraints for MSMEs operating with limited working capital.

REasy expanded MSMEs’ access to “clean-money” payment options, strengthening trust and relationships with suppliers in Asia. By offering cash-deposit on-ramps into transparent stablecoin payments, the pilot enabled micro and small merchants who typically lack such options to transact in ways that are more trusted and verifiable.

This report is the second of a two-part series. The first blog outlined the pilot launch, our learning questions, and the hypotheses we set out to prove. This final report provides an overview of the impact of the solution, and the key insights and learnings from the pilot.

Written by Njeri Muhia, Pilot Manager, Mercy Corps Ventures.