Biostimulants & Biopesticides: Unlocking the Next Frontier in Sustainable Agriculture

Image licensed from Envato.

Today, agriculture faces a dual challenge: producing enough food for a growing population while safeguarding ecosystems in the face of climate variability, soil degradation, and resource scarcity. For decades, the heavy reliance on synthetic fertilizers and pesticides has boosted yields, but at mounting ecological and economic costs. As global food systems shift toward sustainability and resilience, biologically derived inputs (“bioinputs” or “biologicals”) are emerging as powerful complementary solutions. This blog explores not only the promise of bioinputs, but also the business playbook needed for them to scale.

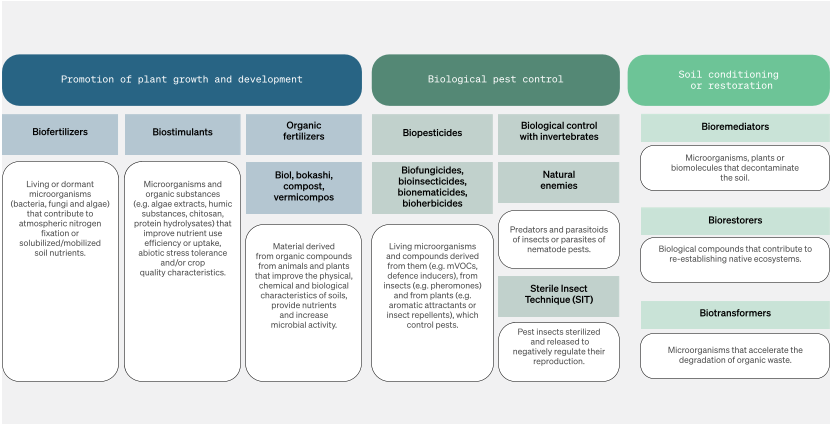

Bioinputs span categories such as biofertilizers, biostimulants, biopesticides, among others, each playing distinct roles in sustainable agriculture. For this post, we primarily focus on biostimulants and biopesticides, to highlight their opportunities and challenges. However, many of the dynamics discussed also apply more broadly across the entire biologicals market, which we will continue to explore in future posts.

Classification of agricultural bioinputs by function

Source: Bullor, L., Braude, H., Monzón, J., Cotes Prado, A. M., Casavola, V., Carbajal Morón., N. & Risopoulos, J. 2024. Bioinputs: Investment opportunities in Latin America. Directions in investment No. 9. Rome, FAO. https://doi.org/10.4060/cc9060en

Biostimulants — often derived from seaweed, algae, chitosan, or microbial sources— support crops by enhancing plant physiology, nutrient uptake, and resilience against both biotic and abiotic stresses. Instead of replacing agrochemicals, they complement them, reducing its dependency while unlocking pathways toward healthier soils and climate-smart farming systems. Their potential goes beyond crop performance – primarily from a yield perspective: localized production and innovation not only lower input costs, but also build regional intellectual property and self-sufficient ecosystems that benefit smallholder farmers and beyond.

Biopesticides complement this by specifically targeting crop protection. Natural formulations – ranging from microbial agents to botanical extracts – control pests and diseases. They reduce ecological footprints, protect pollinators and biodiversity, and alight with tightening global residual regulations.

Image licensed from Envato

Market Tailwinds and Policy Momentum

The timing could not be better. The global bioinputs market was valued at USD 10.6 billion in 2021 and is expected to reach USD 18.5 billion by 2026 (source). Within this, the biostimulants market stood at USD 3.7 billion in 2023, and is projected to grow at a 10–12% CAGR through 2030 (source). The biopesticides market is also expanding rapidly: valued at USD 8.7 billion in 2024, it is expected to grow to USD 28.6 billion by 2032, reflecting a strong CAGR of 16% (source). This strong momentum is mainly driven by stricter regulations on synthetic inputs and surging consumer demand for healthier and more sustainable alternatives.

Emerging markets are at the center of this growth:

The African Union’s CAADP promotes sustainable land management and climate-smart agriculture.

Many governments have embedded support for bioinputs into National Agricultural Investment Plans (NAIPs), lowering adoption costs and accelerating smallholder access.

Countries like Argentina and Brazil have specific bioinput promotion policies or programmes, while Bolivia, Chile, Colombia and Mexico have introduced policy instruments to promote the development, production and adoption of bioinputs (source).

Investment in ag biotech startups in Latin America grew 2000% between 2020 and 2024 (source), thanks to biological-based crop protection products. Brazil is the leading adopter of biologicals globally. More than half of Brazilian farmers already use bioinputs in some form, compared with just ~10% in the U.S., according to EMBRAPA (source). This rapid adoption is driven by several factors: a progressive regulatory framework, a younger generation of farmers more open to innovation, and urgent climate-related pressures that increase pest resistance to conventional chemicals.

AI is transforming how bioinputs are developed:

Traditionally, bringing a new product to market often took over a decade of costly field trials. Now, AI-driven bioinformatics can predict microbial or natural compounds performance under varying soils, crops, and climate conditions. This dramatically shortens R&D cycles from years to months, drastically lowering costs and improving success rates. It also enables faster commercialization, and more targeted solutions tailored to regional ecosystems and stricter regulations.

Companies such as Symbiomics (leveraging sequencing, machine learning, and genome editing to design next-generation biologicals), Taxon (AI-driven bioinformatics for bio-inputs and soil health solutions), and Elytron (AI-powered platform to design and industrialize high-performance biological products) showcase how AI is taking a central role in agricultural bioinputs innovation.

What Startups Must Get Right

Scaling in this sector requires navigating a complex interplay of science, operations, and go-to-market strategy. Five factors stand out:

1. Choice of Base Ingredient

The foundational extract largely determines scope and efficacy. Some of the most common sources include:

Seaweed-based extracts deliver broad-spectrum benefits across crops by targeting common physiological pathways.

Chitosan/chitin — derived from crustacean shells (shrimp, crabs, etc.) — also provides broad-spectrum benefits across multiple crop types, enhancing plant vigor, stimulating root development, and strengthening defenses against both biotic and abiotic stresses. Its versatility makes it one of the most promising bioactive compounds in the sector.

Microbial bases (e.g., bacteria or fungi) tend to be more crop- or threat-specific, offering targeted but narrower applications. A growing trend is to cultivate these microbes through waste-based extraction, using agro-industrial residues (like fruit peels or coffee husks) as feedstock, reducing costs and creating a circular sustainable model.

However, there are challenges. For example, the availability of crustacean shells in Africa is limited, and the extraction process is complex. As a result, many chitin-based biostimulants rely on imports from Asia, which increases COGS and raises the final product price. An alternative gaining traction is the extraction of chitosan/chitin from black soldier fly (BSF) shells, given the rise of insect-protein facilities across Africa. While this could localize production, BSF-derived chitosan is generally of lower quality, creating a trade-off between availability, affordability, and efficacy.

Blending extracts with microorganisms can help mitigate these trade-offs by enhancing both efficacy and resilience to biotic and abiotic stresses.

2. Distribution Strategy

Securing effective commercial distribution partnerships is critical for scale, given the fragmented nature of agricultural input markets and the high costs of last-mile access. Startups typically have two main paths:

B2C (branded products): Offers direct market visibility but requires heavy investment in agrodealer networks, brand-building, technical support and farmer education.

B2B (white-labeling, licensing, co-manufacturing): Scales faster by leveraging established agrodealer and multinational networks, reducing market entry barriers.

3. Extraction Process

Single biochemical extraction: Isolates a compound but creates waste and inconsistent results.

Multiple biochemical extraction: Yields a broader range of active compounds, enhances functionality, and produces no waste. Byproducts can even feed into other industries— diversifying revenue streams.

4. Speed and Visibility of Results

Farmers value inputs that deliver timely outcomes.

Foliar applications often show results in weeks.

Soil-applied solutions may take months.

Products designed to require fewer applications or to align with existing fertilization and irrigation cycles improve practicality and adoption.

5. Ease of Adoption

Practicality and affordability are critical. Solutions that reduce labor intensity, integrate seamlessly into current farming practices, and use standard equipment significantly lower adoption barriers. Equally important, they should require no specialized training, ensuring farmers can apply them confidently without additional capacity building. Formulations that are stable and long-lasting – meaning they do not need to be applied repeatedly throughout the season and can withstand challenges like rain, extreme heat or storage in variable conditions – further strengthen the value proposition. By avoiding cold-chain requirements, special handling or frequent reapplication, biostimulants become significantly more attractive to farmers and distributors.

Structural Challenges

Despite strong potential, several hurdles remain:

Regulation: Fragmented, outdated approval systems mean long, costly registration timelines, often crop- and country-specific.

Patentability: Because many bioinputs are naturally occurring, they rarely qualify for patent protection. Firms often rely on trade secrets or protecting processes and formulations.

Distribution Lock-in: Large distributors may lack knowledge or incentive to promote biologicals.

Farmer Trust: Limited awareness and skepticism — especially among smallholders — slow adoption. Demonstration plots, extension services, and proof of impact are critical.

Absence of specialized investors: Few investors have the technical knowledge to evaluate biologicals, making fundraising challenging.

The winning playbook will likely combine:

Broad-spectrum efficacy extracts

B2B-focused models (leveraging global and regional distribution networks).

Multiple biochemical extraction processes (creating consistent results and multi-industry applications).

Together, these elements align scalability and global demand for sustainable inputs. For investors, the added upside lies in the ability to capture higher-margin export opportunities while catalyzing inclusive local economies.

Final Reflection

The shift toward biostimulants and biopesticides is about more than replacing inputs — it is about redefining the very foundations of agriculture. By enabling farmers to do more with less, restoring soils, protecting their own health, and fostering regional innovation ecosystems, these solutions can simultaneously strengthen food security and climate resilience. We are already seeing this transformation play out across Africa and Latin America. Companies like Coastal Biotech are pioneering seaweed-based formulations in Tanzania; Kentegra Biotech is scaling pyrethrum-based biopesticides from Kenya to global markets; Bio Natural Solutions in Peru is converting agricultural waste into natural biopesticides; Nat4Bio in Argentina is developing microbial fermentation-based coatings; and Lilliput Technologies in Costa Rica is creating biocoatings that optimize plant performance and resilience under climate stress.

We have even started to see significant exits that validate this momentum. In 2023, Belgium’s Biobest acquired Brazilian company Biotrop for USD 569.4 million — a move aimed at expanding into South America and strengthening Biobest’s position as a global leader in biological crop protection, pollination products, and biostimulants. This further confirmed the growing importance of the ag biologicals landscape (source).

The next decade will decide whether biologicals remain a niche supplement or become a mainstream pillar of agricultural production. We believe the trajectory is clear: biologicals are already gaining widespread adoption in markets like Brazil, and this momentum will only accelerate globally. With evolving regulatory requirements, mounting pressure from climate change and growing demand for sustainable solutions, biologicals are poised to shift from “alternative” to “essential”. For entrepreneurs, investors, and policymakers, the choice is clear: engaging early will not only unlock financial returns but also shape the future of food systems globally.