Pilot Launch | Anzi Finance: Leveraging Grain Tokenization to Unlock Credit for Argentina’s Smallholder Farmers

Image licensed from Envato

Mercy Corps Ventures has partnered with Anzi Finance to test how blockchain-based grain tokenization and credit guarantees can unlock access to affordable credit for smallholder farmers in Argentina.

Despite Argentina’s massive agricultural economy, over 170,000 smallholder farmers remain locked out of traditional credit systems due to high administrative costs and a lack of collateral mechanisms.

In partnership with Anzi Finance, Origino — a startup specialized in the tokenization of real-world assets — PrimaryX, the corporate venture capital and crypto innovation lab of A3 Mercados, and Grassi, a company with over a century of experience in grain and oilseed brokerage, this pilot pioneers the use of tokenized grain warrants as collateral. PrimaryX contributes its expertise in blockchain-based financial structuring and its strategic role in fostering agrifintech innovation in Latin America, helping bridge traditional markets with emerging digital infrastructure.

In Brief

Context: In Argentina, hundreds of thousands of smallholder farmers struggle to access affordable credit due to high collateral requirements and administrative hurdles that favor larger agribusinesses. While many farmers store grain in silo bags as a form of inflation-protected wealth, lenders are reluctant to accept grain as collateral because of the cost and complexity of managing, validating, and liquidating it.

Pilot focus: Unlocking access to agri-input credit for smallholder farmers by tokenizing grain and providing blockchain-based credit guarantees.

Solution: Farmers can use their stored grain in silo bags as collateral to access credit, while lenders benefit from seamless, on-chain credit guarantees

Goal: Reduce borrowing costs and increase credit access for underserved farmers in Argentina.

Image licensed from Envato

The Problem

Argentina’s smallholder farmers can’t access credit

Argentina is a global agricultural powerhouse, yet smallholder farmers still lack access to affordable credit due to high collateral requirements, expensive administrative processes, and limited financial guarantees.

Traditionally, farmers can use stored grain as collateral, but the process is riddled with inefficiencies — complex paperwork, manual verification, and liquidation processes that deter lenders, particularly for loans under $20,000.

As a result, most smallholders are forced to operate without formal credit, limiting their ability to buy seeds, fertilizers, and other agri-inputs essential for remaining competitive and resilient — especially as climate risks increase.

Press enter or click to view image in full size

The Solution

Anzi Finance introduces a blockchain-based credit guarantee model combined with tokenized grain collateral.

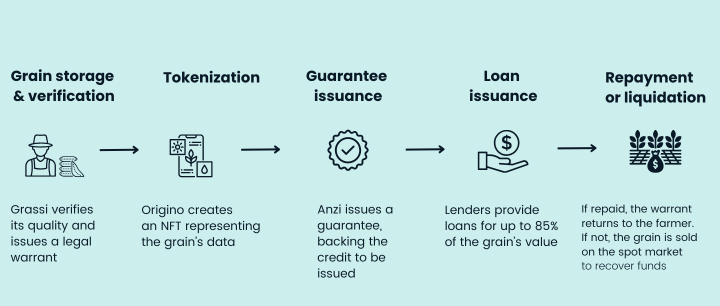

How it works:

Farmers store grain in silo bags, and Grassi (Argentinian grain brokers) issues a legal warrant verifying the grain’s quality and quantity.

Origino’s platform captures key data such as existence, quality, and price to create a proof of existence and proof of quality. This information is stored in an NFT that represents the current state of the silo bag.

Lenders offer loans to smallholders covering up to 85% of the stored grain’s market price.

Anzi issues an on-chain credit default guarantee to lenders, covering up to 100% of the loan in case of default.

If the farmer repays the loan, the warrant reverts to the owner of the product.

If a default occurs, Grassi maganes the sale of the stored grain on the spot market to qualified counterparties.

This eliminates the traditional paperwork-heavy process for lenders while allowing farmers to use inflation-protected grain as working capital.

Key features:

Collateral haircut: Farmers can borrow up to 85% of the grain’s value

Loan terms: 90 to 360 days, aligned with crop cycles

Blockchain: Built on the XRPL EVM sidechain for transparency and automation

Benefits enabled: Thanks to payment programmability, it enables faster payments than traditional options

The Innovation

This is the first global pilot to integrate NFT silo bag grain tokenization with blockchain-based credit guarantees, specifically aimed at serving smallholder farmers.

“This is about turning farmers’ most valuable asset — their harvest — into usable collateral without the friction of traditional finance.” — Matias Marmissolle, CEO of Anzi Finance

Benefits include:

Dramatically lower operational costs for lenders

Faster, automated collateral management

Lower borrowing costs for smallholders

Real-time proof of collateral and easier liquidation

Image licensed from Envato

Learning Agenda & Key Hypotheses

We’re testing three core hypotheses:

Tokenization and guarantees will unlock affordable credit for smallholders.

Measured by loan uptake (including % first-time access), APR reduction, and borrower satisfaction.Blockchain and real-world asset tokenization increase lender efficiency.

Measured by reduction in collateral management costs and guarantee issuance time.Access to agri-input credit strengthens farmers’ climate resilience.

Measured by whether farmers report being better prepared for climate shocks after the pilot.

Image licensed from Envato

Impact Potential

This pilot aims to serve over 50 farmers and, if successful, has the potential to scale across Argentina and into other markets like Colombia and Peru — places where grain-backed credit is underutilized but urgently needed.

Farmers gain access to input financing previously reserved for large agribusinesses.

Farmers can invest in fertilizers, seeds, and tools that improve yields and climate resilience.

Blockchain automates risk management, improves transparency, and reduces costs.

Stay Tuned

This pilot is a critical step toward building climate-resilient agricultural systems through innovative finance. Follow along as we share results, lessons learned, and the potential for scaling.

Follow us on LinkedIn | Follow us on X (Twitter)