Pilot Launch | HesabPay: Digital currency for last mile cash in rural Afghanistan

Photo courtesy of Mercy Corps

In brief:

Digital cash assistance has long been a goal for humanitarian organizations working in Afghanistan, but aid delivery is hindered by poor connectivity, security risks, and restrictions on women’s mobility.

Together with Community Driven Development Organization and HesabPay, we are launching a stablecoin-based pilot to digitally transfer money to rural households in remote areas, ensuring more secure, rapid, and transparent cash distribution.

This initiative aims to build a blueprint for scalable, locally-led digital cash assistance programs, empowering local organizations, enhancing women’s safe access to financial resources, and providing a scalable model for efficient humanitarian aid delivery by leveraging stablecoins in hard-to-reach communities.

Photo courtesy of Mercy Corps

The Problem

Afghanistan’s humanitarian crisis is critically underfunded, and providing local partners with cost-efficient, secure, and user-friendly cash delivery mechanisms is essential to stretching limited aid budgets. While digital cash assistance has long been a goal for humanitarian organizations working in the country, many remote regions remain excluded from digital financial services, complicating the existing challenges of delivering aid.

Key problems include the high costs and risks of delivering cash assistance to isolated areas, where liquidity is scarce and connectivity limited. Vulnerable communities that lack connectivity are financially and economically excluded. Current efforts to use emerging tech to deliver aid are not inclusive and overlook the need for localization, leaving local actors without the digital tools they need to scale their impact.. The increasing scarcity of humanitarian funding makes it even more important to put digital delivery tools in the hands of local actors. This could compound cost savings and improve the speed and scale of delivery. However, poor connectivity remains a major obstacle. While HesabPay’s digital currency delivery system is a major breakthrough for Afghanistan, it is limited to urban areas, excluding over 70% of Afghanistan’s population from receiving digital aid. Adding satellite connectivity hubs as part of the service offering to humanitarian actors could extend coverage, expanding access and reach.

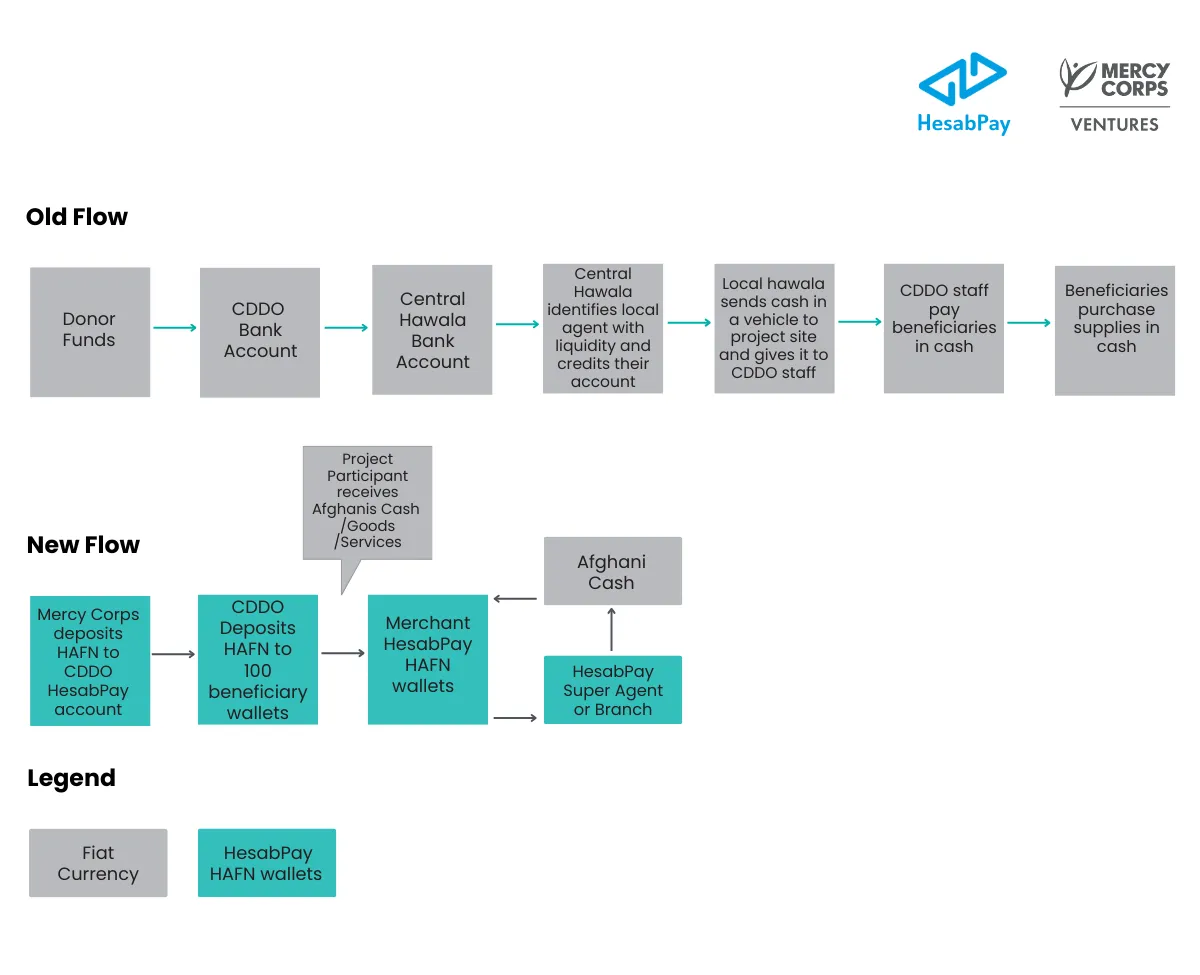

For decades, Afghanistan’s remittance system has relied on the hawala network — an informal money transfer system based on trust and intermediaries. While effective, hawala transactions are slow, opaque, and expensive due to high commission fees and middlemen involvement. In remote areas like Gardez, cash must be physically trucked in, often crossing through highly insecure areas, compounding the costs and risks of delivering aid to rural communities.

Our new pilot with HesabPay will be a critical test for how local organizations like CDDO can bridge the gap and extend digital financial services and cash assistance to underserved regions. By empowering local humanitarian actors with a stronger footprint in remote and underserved communities, it could redefine how aid is delivered not just in Afghanistan, but across other conflict-affected and hard-to-reach regions globally.

Photo courtesy of HesabPay

The Pilot

In the rugged, remote corners of Afghanistan, where humanitarian aid is scarce and digital financial services remain a distant dream, a quiet revolution is underway. The Community Driven Development Organization (CDDO), in collaboration with HesabPay and Mercy Corps Ventures, is pioneering an innovative pilot program that could redefine the role local organizations play in the humanitarian assistance landscape.

CDDO will be transferring $100 per month to 100 rural households in and around the mountainous area of Gardez. These funds will be disbursed digitally in HAFN, a local stablecoin supported by HesabPay. However, this initiative is not just about financial aid — it is about inclusion, empowerment, and the immense value that emerging technology offers to local organizations in delivering aid quickly and effectively to remote locations where international humanitarian actors do not have a presence.

To address the financial access gap in rural Afghanistan, CDDO and HesabPay are deploying blockchain-powered cash transfers that allow local organizations to deliver aid at scale, with the same efficiency and speed as international counterparts.

How it Works:

Community-Based Selection: Participants are identified through CDDO’s local networks, ensuring that aid reaches those most in need.

HesabPay AfPay Cards: Each recipient receives a magstripe and QR code card with a static PIN, allowing them to access digital currency even in areas with limited connectivity.

Merchant & Agent Onboarding: Local vendors and community agents are enrolled to facilitate the exchange of digital currency for cash, goods, and services.

Satellite Connectivity Hubs: In areas with no connectivity, HesabPay will add connectivity hubs to their services for humanitarian clients, enabling transactions and seamless digital payments in remote locations.

Learning Agenda & Key Hypotheses

Through this pilot, we aim to demonstrate how blockchain-enabled digital cash assistance will promote more effective, efficient, inclusive, and safe transactions.

Hypothesis 1: Local organizations can use digital wallets to implement cash programs more effectively and efficiently compared to traditional approaches.

KPI 1.1: Percentage reduction in operating costs, cash delivery costs, and delivery time compared to traditional methods.

KPI 1.2: Percentage of households reporting that digital cash helped meet their basic needs.

KPI 1.3: Percentage of households spending digital cash for its intended purposes.

Hypothesis 2: Digital wallets can provide an inclusive and user-friendly way for people to disburse and receive cash assistance in remote areas that lack connectivity.

KPI 2.1: Percentage of pilot participants, local merchants, and CDDO staff who find HesabPay easy to use for digital payments and cash distribution.

KPI 2.2: Percentage of participants with sufficient knowledge to use HesabPay independently in the future.

KPI 2.3: Percentage of female recipients and other marginalized groups who independently access digital payments using HesabPay, and the number of recipients planning to continue using HesabPay beyond the pilot.

Hypothesis 3: Using digital wallets can reduce the security risks and costs of delivering cash assistance in remote areas.

KPI 3.1: Percentage of participants and staff that feel safer receiving funds digitally versus traditional method (cash in hand).

KPI 3.2: Reduction in security-related costs associated with using traditional/cash delivery methods.

Looking Ahead

This post is the first in a two-part series, with a post-implementation analysis evaluating impact and scaling potential to follow. If successful, this model could transform the approach to humanitarian aid delivery in fragile contexts, setting a precedent for locally-led, blockchain-powered financial inclusion.

Photo courtesy of Mercy Corps

Stay Tuned

We invite you to follow our journey as we test innovative financial solutions that empower local communities in Afghanistan. Together, CDDO and HesabPay are not just delivering aid — they are building a foundation for long-term resilience and financial empowerment.