Crypto For Good Fund III — Ecosystem Insights

In this blog, we provide an overview of the Crypto For Good landscape in emerging markets. These findings are based on more than 500 proposals received from the past three iterations of the Crypto For Good Fund, and offer unique insights to builders, funders, and others working on real world web3 use cases for financial and climate resilience in Africa, Latin America and Asia.

In brief

Since 2022, we have screened more than 500 real world web3 use cases in Africa, Asia and Latin America. Here are a few themes we’ve identified from over 130 proposals from Crypto For Good Fund III:

Crypto is global, with web3 teams operational in 40+ emerging markets

Africa is leading the way (52% of pipeline); Latin America and Asia represented 28% and 14%, respectively

Top 5 countries: Nigeria (global #2 per Chainalysis), Kenya (#21), India (#1), Brazil (#9) and Colombia (#32)

2. Builders are leveraging web3 tech to solve for a variety of intractable societal challenges

22% are working on Regenerative Finance (ReFi)/Decentralized Finance (DeFi) solutions; an additional 17% are focused on climate innovation

16% are focused on real world assets (RWAs)/asset tokenization; 14% are building on- and off-ramps to web3

10% are using web3 tech to improve humanitarian aid delivery

3. Solutions are focused on underserved populations

23% are building for low-income populations

Another 23% are building for smallholder farmers

15% are developing solutions for microentrepreneurs or small- and medium-sized enterprises (MSMEs)

10% are focused on migrants, refugees, or displaced persons

The next billion users will come from the Global South, where web3 can solve real world pain points for the 1.4 billion unbanked and 3.3 billion climate-vulnerable people around the world.

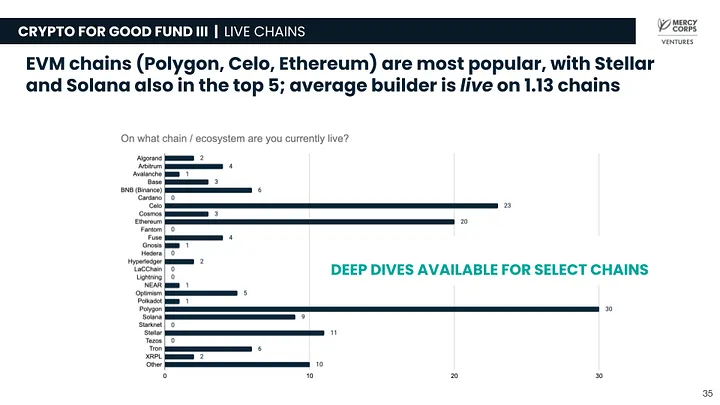

4. Builder activity is fragmented across multiple chains

Over 25 different blockchains are represented in our data

— Ethereum and L2s lead the way (Polygon, Optimism, Base and Celo), along with Solana

Only 38% of builders are focused exclusively on one chain

— The average builder plans to launch on ~3 chains; 26% are on 4+ chains

A cross-chain ecosystem needs to develop which prioritizes user needs and interoperability in emerging markets.

5. However, the market is still nascent, with most products and companies still in the early stages

Only 27% had products deployed (soft or fully launched), while the large majority were still under development

Only 30% had completed a formal fundraising round (pre-seed+), while only 11% had raised $1M+

55% of companies have users, but only 17% have more than 1,000 users

Dedicated impact venture capital and post-investment support is required to support web3 founders in emerging markets.

“We remain deeply committed to the role that web3 technologies can play in building financial and climate resilience in emerging markets. The Crypto For Good Fund is a unique vehicle funding impactful real world use cases and building the evidence base for how crypto can be used for good. We are thrilled to continue supporting passionate builders in this space.”

Scott Onder, Managing Director, Mercy Corps Ventures

* * *

In September 2023, Mercy Corps Ventures launched the third edition of the Crypto For Good Fund. The high-level objective remained unchanged: fund impactful real world web3 use cases to drive global financial inclusion and climate resilience across emerging markets, building an evidence base to prove the scalability of blockchain-enabled solutions in creating positive, lasting change.

The call for proposals attracted over 130 high-quality applications from more than 40 countries, with significant representation from underrepresented and gender-diverse teams.

DeFi, ReFi, climate innovation, RWAs, ramps and humanitarian aid delivery are the most web3 popular use cases in the Global South.

Three-quarters of the applicants are building for low-income users, smallholder farmers and MSMEs.

EVM chains (Polygon, Celo, Ethereum) are most popular, with Stellar and Solana also in the top 5; the average builder is live on 1.13 chains

For inquiries or collaboration opportunities, contact Kenneth Kou (Head of Venture Lab): kkou@mercycorps.org