Adapting to a new reality (4): Introducing our Climate Adaptation & Resilience Framework

Introducing a first-of-its-kind framework for identifying, understanding, and analyzing the potential climate adaptation and resilience impact of early-stage startups

This blog is the fourth and final piece in a series articulating our climate resilience approach at MCV. The first blog explains why, after years of investing in climate resilience solutions, we decided to expand our climate resilience focus into other parts of our work. Our second blog outlines how we have done this within our Climate Venture Platform, and our third blog introduces our self-serve Climate Risk Assessment tool for startups.

Introduction

The climate resilience space is accelerating rapidly and drawing in greater interest and investment. This growing awareness is accompanied by a fair share of confusion and noise, stemming from varying levels of understanding as many stakeholders bring different and differing definitions and interpretations. From entrepreneurs, asset managers, and asset owners alike, we are hearing questions such as: “What counts as climate adaptation?” “What is climate resilience?” and “How do we measure it?”

After comprehensive research and learning, MCV is cutting through the noise to provide clear definitions as well as a taxonomy for breaking down “climate resilience” into more tangible steps. Steps to assist with analyzing, measuring, understanding, and enhancing climate resilience impact — from investment analysis all the way through to post-investment support. Our Climate Adaptation and Resilience (CAR) Framework was first developed as an internal tool to guide our investment decisions and measure their impact over time. However, we soon realized that we were not the only ones grappling with these questions. In line with our commitment to transparency, we are sharing our framework publicly so peer investors, partners, and startups can benefit from it and contribute their own ideas.

With tools such as our CAR Framework and Climate Assessment Tool (shared in an earlier blog), investors can make smarter, more informed investment decisions, meet entrepreneurs wherever they are in their respective climate journeys, and more clearly and accurately communicate the impact of products and services on the climate resilience of individuals and communities.

Climate Adaptation & Resilience Framework

Below we detail the different elements of our CAR Framework and how we put it into practice within our standard investment process.

Agree on Definitions

Climate resilience is a broad term, prone to myriad and sometimes unclear interpretations. Definitions are important to ensure the work being done creates the intended impact. In order to develop a framework for measuring the impact of products and solutions on climate adaptation and resilience, we first need to agree on how to define these terms.

Across the impact investing space, we have seen the term climate mitigation become an increasingly well-understood concept. It is possible to articulate both the goal (achieving net zero emissions) as well as the impact of climate mitigation efforts, since they typically aim to reduce, stabilize, and/or offset carbon emissions, which is a quantifiable metric.

However, there is much less consensus around the term climate adaptation — what it is and how to measure it. A reduction in risk from potential future climate events is difficult to articulate, quantify, and standardize. In interviews with ecosystem players, it became clear that climate adaptation and resilience still lack clear definitions and precise metrics. There is a consensus gap across the investment space, with different actors testing multiple ways to define and measure climate resilience (more or less narrowly depending on their investment scope and capital requirements).

MCV has worked carefully on these definitions in order to make smarter, more informed investment and portfolio management decisions. We use the following definitions, which are the product of extensive desk research, discussions within the team and with ecosystem partners, as well as learnings and insights from our investment portfolio.

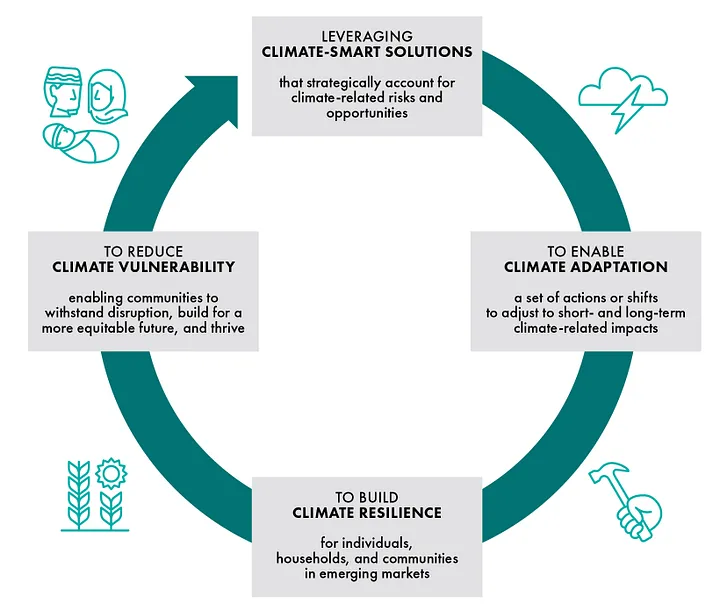

The below diagram illustrates how we view the relationship between the terms defined above. Climate vulnerable individuals and communities leverage climate-smart solutions to enable climate adaptation, which in turn helps to build climate resilience, which ultimately reduces climate vulnerability. At MCV we consider this a cyclical process rather than a linear one because it represents a series of ongoing, long-term actions. Climate adaptation is not a one-time change, but rather a set of shifts and adjustments that happen over time, building climate resilience in the long-term.

MCV’s Climate Resilience Cycle

2. Determine Climate Resilience Linkage

For every potential investment opportunity, we first determine the strength and degree of the link between the solution and the resulting climate resilience impact using the matrix below.

We think of Level 1 solutions as being products and services that are very intentionally built to directly enable climate adaptation or contribute to climate resilience. While it’s difficult to generalize, as every company’s solution is unique, examples of Level 1 solutions might include localized crop insurance or affordable irrigation for smallholder farmers. Level 2 solutions are not as clearly or directly linked to climate resilience as Level 1 solutions, but can still be leveraged to support greater adaptation and improved resilience. Examples of Level 2 solutions include price and market intelligence platforms for smallholder farmers, data analytics tools to improve supply chain transparency, or digital identity products for climate migrants. Lastly, Level 3 solutions are those which do not have any defensible link to climate resilience for emerging market communities and are therefore beyond the scope of our investment thesis. Level 3 solutions might include a basic payments platform, an inventory management software, or a gaming product.

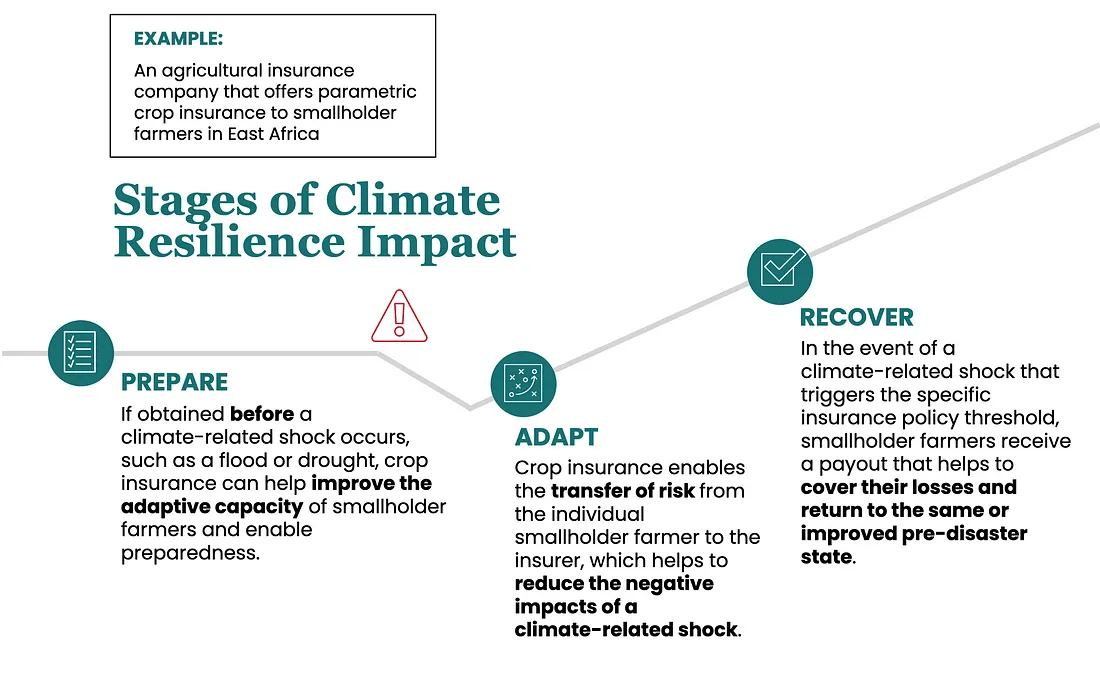

3. Apply the Climate Resilience Taxonomy

Since there is not a universal definition or metric for climate resilience, there is a need to break the concept down into distinct stages. This helps us better evaluate a specific route to climate resilience impact that is tailored to each company’s product or service. For Level 1 and Level 2 solutions, we use the following taxonomy to determine at which stage of the climate resilience cycle a potential solution might create impact: 1) Prepare, 2) Adapt, and 3) Recover. It is important to note that these three stages are not mutually exclusive and solutions may contribute to positive impact at multiple stages of the climate resilience cycle.

When we are conducting due diligence on a potential investment opportunity, we use this taxonomy to identify at which stage(s) the company’s product or service has the greatest potential for positively impacting the climate resilience of the end user, whether that’s a smallholder farmer, a small or medium-sized enterprise owner, or an informal worker in the gig economy. We know that climate resilience looks different for each of these user groups and the Prepare, Adapt, Recover taxonomy allows us to drill down into the details and chart out our strongest hypothesis of how exactly that route to impact might work.

To help make this framework more tangible, let’s use an example of a hypothetical agricultural insurance company that provides parametric crop insurance to smallholder farmers across East Africa. In walking through each stage of the climate resilience cycle, we ask ourselves: What might need to be true about the product/service design to create climate resilience impact at one or more of the three stages? Are there stages where there is no clear climate resilience impact? Which of the three stages does the existing evidence base support (if any)?

4. Develop the Theory of Change

Following the climate resilience taxonomy, we then develop a theory of change for each potential investment. The Theory of Change includes Inputs/Activities, Outputs, Outcomes, and Impact. We use the relevant stage(s) of the climate resilience cycle to guide the specific route to impact for the investment opportunity under consideration.

Given our investment focus on early-stage companies that are developing innovative, first-of-their-kind products and services, there is rarely an existing solution we can turn to for comparison when creating the theory of change. Therefore, we leverage our own portfolio learnings and external research on similar product types or technologies (as available) to help us craft the strongest, most informed theory of change possible at this stage.

5. Identify Relevant KPIs

After developing a theory of change for the product or service under consideration, the next step is to identify the preliminary key performance indicators (KPIs) to illustrate how a company will achieve or contribute to the intended climate resilience impact.

Climate adaptation and resilience is contextual. It can mean different things for different segments of the population, such as smallholder farmers, low-income women, or informal gig economy workers. Thus, there is no ‘one-size-fits-all’ indicator to measure climate adaptation and resilience.

At Mercy Corps Ventures, we individually assess each potential investment’s climate resilience impact and identify a unique set of indicators tailored to the specific sector, business model, and geography of each solution. Rather than imposing a list of standard climate resilience metrics, we help portfolio company teams develop their own theory of change and identify the specific metrics that are right-fit for them.

There are several ongoing initiatives in our ecosystem to develop some level of standardization and guidance around climate resilience metrics for investors and entrepreneurs. One such example is the Global Impact Investing Network (GIIN)’s Navigating Impact Project to develop a core metrics set specifically for investments and solutions related to climate adaptation and resilience, which we have been actively involved in as a working group member for the past year and a half.

The GIIN’s Navigating Impact Project includes a recently launched Climate Adaptation & Resilience impact theme

Continuing with the same example from above, of an agricultural insurance company that provides parametric crop insurance, we can leverage the tools from the GIIN’s CAR impact theme to align with the most relevant strategic goals and to identify suitable metrics for measuring and managing the company’s impact.

6. Measure and Manage Impact

Post-investment, we work closely with our portfolio companies to understand, measure, and communicate the impact achieved through their products and services.

Given that the climate impact of each portfolio company is unique to its specific business model and value proposition, we intentionally embed impact reporting and monitoring into our overall portfolio management process. This allows us to closely collaborate with each company to assess their progress, overcome challenges, and iterate and adapt their product based on customer data.

Because we invest at the earliest stages, it is very possible (and in fact quite common) for a company to pivot as they learn from their customers and improve their product or service. Our right-fit approach allows for the evolution of a company’s theory of change and subsequently a reassessment of the relevant impact KPIs as a company grows. Given our long-term relationship with portfolio companies and our in-house impact measurement expertise, we have the capacity to support them through these business pivots and learn alongside them as we collectively work to scale the most impactful solutions for climate resilience.

Get involved!

Try it out! Take the definitions we’ve provided back to your teams and share them around. How do they resonate with how you think about climate adaptation and resilience?

Experiment with using the Prepare, Adapt, Recover taxonomy with your own investment portfolio or with your own early-stage startup. Does thinking about climate resilience as three distinct (yet very related) stages help you to more specifically define and articulate the impact of your product or service? Is there one stage that resonates more with your team’s work?

Explore the GIIN’s Climate Adaptation & Resilience impact theme and see which of the strategic goals and metrics fit best with your work. Share your feedback with the GIIN based on your unique experience and expertise.

Check out additional resources from the CIFAR Alliance’s Climate Adaptation & Resilience Metrics CoLab, including their recent benchmark analysis of frameworks for measuring climate resilience and adaptation.

Let us know what you think! We heartily welcome and encourage you to share your feedback, questions, additions, and ideas. We would love to hear your thoughts on our Climate Adaptation and Resilience Framework and whether you find it useful for your business or for companies you work with. As an ecosystem we are on a collective learning journey and collaboration and consensus is essential for reaching our shared goals of strengthening the resilience of individuals and communities in emerging markets.

Reach out to us here.